How to Add Liquidity to a DEX(Part6)

Liquidity Pool:

When someone sells Token A to buy Token B in a DEX, they rely in the A/B Liquidity Pair Tokens provided by other users.

When they buy B tokens, there will now be fewer B tokens in the pool, and the price of B will go up. It's simple supply and demand economics.

Liquidity pools are smart contracts that contain blockchain tokens provided by users of the platform.

They are self-executing and do not need intermediaries to function.

They have other pieces of code, such as Automated Market Makers (AMMs), which help maintain equilibrium in liquidity pools using mathematical formulas.

Step 1:

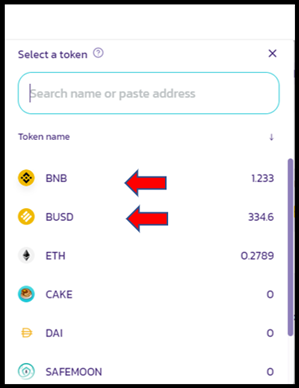

The wallet must have sufficient funds of both tokens; in this example we will take the BNB/BUSD pair.

We have connected the MM wallet with the PancakeSwap DEX, click on Liquidity then Add Liquidity.

Step 2:

In Add liquidity put the amount of 0.5 BNB and then in select currency search for the other token.

It shows the list of available tokens in the DEX.

Step 3: Select the BUSD token:

The DEX indicates that 0.5 BNB corresponds to 239.52 BUSD.

Click Approve, the MM wallet requests permission to access the funds.

It also indicates that the transaction will cost 0.11 USD or its equivalent in BNB.

Step 4: The DEX reports that:

Credits 10.4925 LP Tokens as proof of investment, representing 0.004443% participation in the liquidity pool.

Upon confirming the supply, the MM wallet indicates a gas fee for the transaction of 0.1 BNB, to contribute a total of 0.6 BNB.

Step 5: In the BSC testnet browser, when entering the address of the purse or account, we see that:

The balance of BNB = 0.7291 decreases.

The balance of BUSD = 95.14 decreases.

10.4925 LP tokens.

Step 6: Finally:

From the browser copy the address of the LP token contract.

List the LP tokens in the wallet.