Future of Financial Markets Securities Tokenization

Introduction

"The next generation for financial markets will be the tokenization of securities." Larry Fink, CEO of BlackRock.

Larry Fink is a billionaire businessperson and the Chairman and CEO of BlackRock, which is an American multinational investment management corporation. BlackRock is the largest money management company globally, overseeing over $10 trillion in assets.

Analyzing Larry Fink's statements at a New York Times event involves understanding two key concepts:

Negotiable securities in a financial market.

Blockchain technology for asset tokenization.

Types of securities traded in a financial market.

The EDUCA portal of the Chilean Financial Market Commission pedagogically explains these financial concepts:

The stock market functions similarly to other markets for goods and services, but instead focuses on financial instruments. Transactions in the stock market involve buying and selling through intermediaries, either on a stock exchange or outside of it, or through direct negotiation between interested parties.

Participants:

Issuers of Securities.

These are entities such as corporations, mutual funds, investment funds, and banks that offer securities.

Claimants of Securities.

People or institutions seeking to obtain profits through the acquisition of investment instruments.

Brokerage of Securities.

Operations that bring together buyers and sellers, facilitated by entities like securities agents, stockbrokers, and banks.

Regulators and inspectors.

These entities, such as the Financial Market Commission (CMF) in Chile and the U.S. Securities and Exchange Commission (SEC), supervise and ensure that the activities and participants in the stock market adhere to legal regulations.

Financial markets.

These are entities where stockbrokers and traders can buy and sell securities, including stocks, bonds, and other financial instruments.

Here is a brief description of securities or financial products commonly found in the stock market:

Debt instruments: These provide a fixed and known return, offering a predetermined interest rate and the return of the principal amount. For example, if you purchase a $100 bond with a 10% yield for one year, you will receive $110 at the end of the year.

Capitalization instruments: The profitability of these instruments varies based on market conditions. The value of a company's shares, for instance, may decrease to $95 on one day, increase to $120 in two months, and return to the initial investment of $100 after a year.

The risk associated with stock market instruments is linked to the expected return. All investments carry some level of risk, and each investor must decide their preferred risk tolerance in pursuit of higher returns

Blockchain technology to tokenize assets.

What is an ERC20 token:

It is a set of instructions written in a smart contract deployed on the Ethereum blockchain and other compatible blockchains, which enables a variety of functions, including the constructor function creates a total supply of coins or tokens:

Example 1. Issuance of one million "BONUSlatam" tokens that represent one million bonds of the "Latam Oil Company" with a value of 50 USD each. Credited to the balance of the contract owner's account:

0x1FA2fC3e709AcD1D90c4cD9343d9f437CC9CfEf8

Example 2. Issuance of one hundred million “BMWshares” tokens representing one hundred million shares of the BMW automotive company, each with a value of 80 USD, are credited to the account balance of the contract owner:

0x30D752489CF27652fcc2553AAaaB2D5DD9359C80

Note: In practice, ERC20 contracts are more complex, it involves deploying a family of more than one hundred Smart Contracts (SC) for each project, each one with mathematical functions to execute a specific action such as:

Control access to funds.

Transfer ownership of the SC.

Pause operations.

Send or transfer a certain number of tokens to other accounts.

Burn or remove tokens.

Authorize or delegate the distribution of tokens.

Issue events like he sent tokens to other accounts.

Tokenize the shares of a company

In Example 2, we want to tokenize one hundred million shares of the automotive company BMW, each with a value of 80 USD.

Step 1: The development team selects the SC ERC20, which meets the conditions of the issuers of the shares, which will be the owners of the tokens.

Step 2: Select the name, symbol, and total supply of the tokens.

Step 3: To deploy the SC ERC20, you must have an Ethereum or compatible account or address to credit the tokens to be issued (I did this example on the Binance blockchain).

0x30D752489CF27652fcc2553AAaaB2D5DD9359C80

Also, funds in a crypto wallet to cover the expenses of deploying the SC.

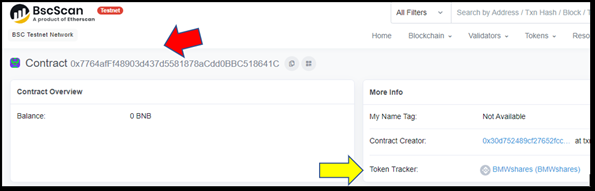

Step 4: Deploy the SC, identified by an address:

0x7764afFf48903d437d5581878aCdd0BBC518641C

Step 5: We can verify our contract in the Binance blockchain explorer:

I write the address of the SC (see red arrow in the image below).

I have the tokens in the explorer (see yellow arrow).

Next, in the address of the owners or issuers (red arrow), we credit the one hundred million BMWshares tokens (yellow arrow).

Step 6: Finally, we register the Smart Contract in the crypto wallet, this allows us to have the one hundred million tokens:

We write the address of the SC in the Metamask wallet (red arrow).

The name of the shares BMW shares.

In the second image, the tokens are ready to be sent to the buyers of the tokenized shares (red arrow).

What tokenized assets we currently find

There are online platforms or brokers to trade tokenized assets such as IQBrokers. We find tokenized raw materials such as gold, oil, silver, and shares of companies such as Coinbase, Tesla and Amazon.

Note: The authorities of the most important financial markets in the world have not granted permits to dozens of platforms.

A successful tokenization projects

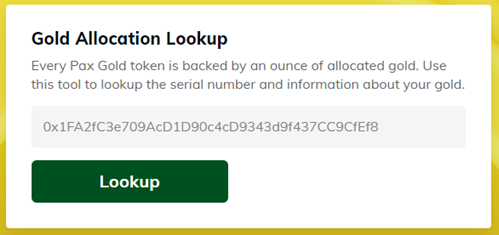

Pax Gold (PAXG) is a digital asset. Each token corresponds to one fine troy ounce of gold stored in the Brink vaults, London.

If you own a PAXG token, you own the underlying physical gold, which is in the custody of the Paxos Trust Company: (“Paxos—How the Global Financial Crisis Inspired the Creation of the ...”)

If gold goes up or down in value on the market, the PAXG token does. You can see the prices on the Coinmarketcap.com website.

As of December 30, 2022, 271,264 PAXG tokens had been issued.

Credit to an account or address on the Ethereum blockchain such as: 0x1FA2fC3e709AcD1D90c4cD9343d9f437CC9CfEf8

You can check if the PAXG token is in your account.

We can buy it on the official Paxos website or on secondary markets or cryptocurrency exchanges such as Coinbase and Binance.

Final remarks:

Tokenization facilitates the exchange of ownership of financial instruments.

Tokenization reduces the barriers to access capital for those who have projects to finance and for those who seek to invest their funds.

The risks inherent in any investment accompany the investment in tokenized assets.