Design a Successful Crypto Model Like Bitcoin.

Deflationary token issuance model

In Article 1, we studied the inflationary model, with a function in which the quantity of the token is the independent variable and the token is issued, even if the price is falling, leading the project to failure.

In this second article, we study the deflationary model: Price is the independent variable, with token issuance decreasing over time, making the token a scarce good.

The Bitcoin

Although it shows short-term price volatility, Bitcoin has had an increasing behavior in the long term (chart in logarithmic scale):

Exponential function algorithm to describe the supply of a product (token)

I = Income or capital obtained measured in thousands of Ethers.

X = Amount of tokens in the market measured in millions.

The project managers must do a feasibility study to know the revenue and quantity, for didactic purposes we will use revenue of 67 (thousand Ether) with a total of one hundred (million tokens).

If we choose this function for a token offer: f (X) = eax - 1

The horizontal axis (x) represents the amount of token in the market in millions.

The vertical axis (Y) represents the income in thousands of Ethers,

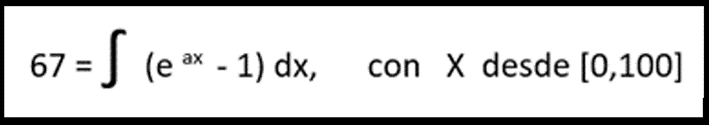

The area under the curve that describes the function f(X), from X = a to X = b represents the income (I):

I = Income= (Price) (quantity) = A = Area under the curve

Formulation of our case:

X = a = 0

X = b = 100

f(X) = eax – 1

A = 67 (thousand Ether)

Solution:

Solving by the variable substitution method U = aX

Differentiating both sides du = a dx

With the integration formulas of exponential functions

The equation results: 67 = 1/a [e100a - (100 a + 1)] applying the trial-and-error method:

The value of a = 0.0095 corresponds to an income of: I = A = 67 (thousand Ether)

The equation to determine prices (Y) based on the amount of the token (X):

Y = e0.0095 X - 1

The equation to determine the income (I) based on the token amount (X):

Multiply both sides by X:

X Y = X (e0.0095 X - 1)

How X Y = I = Income

I = X (e0.0095 X - 1)

The trial-and-error method allows to solve this implicit equation:

For a given income, assume a value of X which is the amount (in millions of tokens).

Step 1: Income of ten thousand Ether.

When the income is 10,000 Ether, there will be thirty million tokens on the market.

Step 2: Income of twenty thousand Ether.

When the income is 20,000 Ether, there will be forty-two million tokens on the market.

Step 3: Income of thirty thousand Ether.

When the income is 30,000 Ether, there will be fifty million tokens on the market. We continue like this until we reach the income of 67,000 Ether.

When the income is 67,000 Ether there will be seventy-one million tokens on the market.

Model results

Summary of previous results:

The initial issuance is thirty million tokens, the second is twelve million, the third is eight million and the last issuance is four million, reaching a total of seventy-one million tokens in the market.

Applying the price equation Y = e0.0095 X - 1

The first 30 million tokens are sold at 1,300 Ethers and the price goes up until it reaches 1,963 Ethers.

The percentage of emission with respect to the tokens in the market, is becoming smaller, which makes the token a scarce commodity and therefore the price increases.